Financial Education: 8 Tips to Teach Your Kids How to Manage Money

Categories: Finance

Beacon Financial Education was created with the purpose of providing individuals with the information they need for financial control, stability, and simplicity. Educating yourself and making sure you know what’s going on in the “world of finance” is also a good way of showing your children how to acquire and maintain financial health. Here, BFE provides you with these 8 tips that will help you teach your kids how to manage money.

The Importance of Financial Education

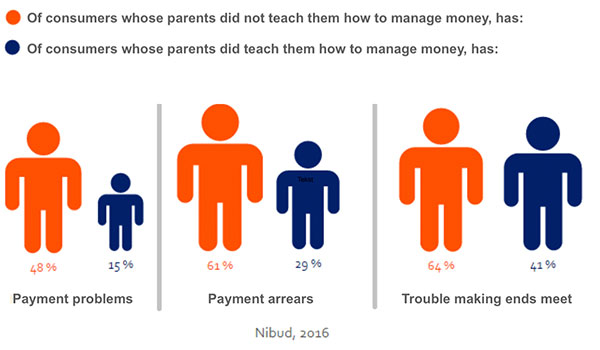

Educating your child(ren) about money, saving, and spending is key in its/their upbringing. The Dutch Institute for Budget Information (Nibud) published a report in 2016 that demonstrates this importance.

It shows that making ends meet is pretty difficult, even if your parents taught you how to manage your money. But those who were not lucky enough to receive, some degree of, financial education from their parents are even more likely to end up have problems paying their bills.

Those who received financial education from their parents also tend to save more money, more frequently compared to those who didn’t (84% vs. 69%), said they received pocket or clothing money from their parents (84% vs. 64%), and had parents who managed their finances well themselves (90% vs. 38%).

So, if you want to provide your child with a good knowledge of how to handle his or her money, make sure to start at an early age. Teaching them about financial independence – and giving them some pocket money to go with it 😀 – might be one of the greatest gifts you could give them.

Knowing Your Child: Types of Money Spenders

Before we continue it is good to realize that based on our personalities, besides our upbringing, we all are a certain type of spender. Understanding and knowing your child and what – essentially – drives them proves to be very useful when educating about money.

The trendsetter, impulse, or emotional spender, for example, should be taught how to deal with advertising that’s targeting them all day. The so-called dodgers or avoiders should learn how to make a financial plan, so they don’t hide from or ignore their money situation. Naturally, budgeting is crucial to over-spenders or those with a hedonistic tendency and savers could be educated about financial risks and when it is important to avoid them, but also in which case they could lighten up a bit.

So, let’s start with some tips that will help your children become financially literate.

1. Learning by doing: pocket money

Six is a good age to start introducing financial education. Give your child cash pocket money, so it is tangible for them and they learn that money is more than just some digits on a screen.

When they are older you can also choose to give them their money digitally. This way they will also learn about online banking and managing a digital wallet.

2. Make financial education fun!

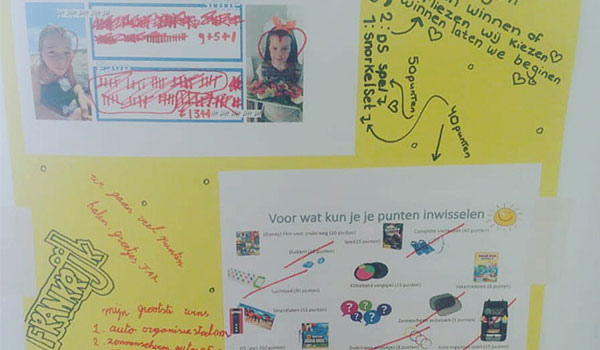

Go out shopping with them and let them pick out a nice piggy bank to put their money in. Sit down together and decorate a calendar that you can hang in their bedroom and note the dates by which they will receive their pocket money. This way they can count down/ stripe off the days until their next pocket money payment. You could also make a list of chores with which they can earn some extra pocket money for special occasions. For example, spending money on a holiday. Or reward good behavior with a point list that earns them some money.

You could also make some scans of actual coins and banknotes and print them to play shop with or some fun games – teaching them about money at the same time.

3. Teach them how to save

Start at the very beginning: they cannot spend what they do not have or haven’t earned. So, when introducing pocket money, make sure they start with saving some, if not all (in the beginning), of the money they are given, and have them put it in their new piggy bank.

4. What money can buy

Achieving financial independence starts with giving your child responsibility for their own money. Give them the opportunity to do it themselves. But guide them along the way.

When you start giving them pocket money, they probably will want to buy everything and anything. As previously mentioned, they are seduced daily by clever ads and commercials with all these nice sweets, toys, and gadgets they will want to have. It is up to you to educate them that they are only able to spend their money once!

Depending on their age and math skills there are several ways in which you can teach your child what their money can buy.

In the Netherlands, for example, people will find thick colorful toy brochures in their mailboxes when Sinterklaas and Christmas are around the corner. Going through these brochures with your child can be a good – but also frustrating and difficult – way to show what their money’s worth. Open up their piggy bank and count how much money they have. Determine which amount they are allowed to use to buy something from the brochure. Then go over the things they would like to have and explain what they can and cannot buy, and how much more money they would have to save in order to buy certain things.

Another way to teach them about the value of money is to – while doing groceries – give them some money or tell them a certain amount they can spend on something — say 2 euro. They can choose, whether it is a dessert, cookies, or fruit. Help them make their selection and explain the “consequences” of their choice. If they buy this, they cannot buy that.

5. The mobile phone

Sometimes it is hard for us to imagine, but the fact is, cell phones just are part of today’s life, even that of children as young as 8 or 9. By the time kids go to high school, only 3% do NOT have a mobile phone of their own. Again, this is another good opportunity to sit down with your child and take a good look at getting a phone from a cost perspective. Do they get one of your old phones, or do they get a new one? Prepaid or a subscription? How much MB of internet, et cetera?

6. Loosen up the reins

The older they get, the more responsibility they can handle and the better they can manage their money. When they start going to high school you can also introduce clothing money; a certain amount per month they get to buy their own clothes and shoes with. This will also contribute to their money management skills. They might need to save another month before they can actually buy what they want.

Also, during their teens, they might have some jobs and earn their own money. They have their own bank card. Pay some bills. Wire money themselves. Time for you to slowly loosen up the reins and have them make their own money decisions.

7. Making mistakes is part of the process

Overprotective parents are the number one obstacle in achieving financial independence. Of course, you want to protect them from making financial mistakes. But making mistakes is simply part of the learning process. Disappointments, bad buys, misleading salespeople: this is life! We dealt with it; they will deal with it too!

8. Practice what you preach

You are the first and most important example your children have when it comes to money management. After all, children learn by example and by imitating that what they see. If you spend money easily or buy things you do not really need, your child will do the same. If you tend to overspend, your child will probably do the same. If you save, your child is more likely to put money aside as well.

Be clear and open with your kids. Tell them about debts and loans, about credit cards, about student loans and people having to take out loans to be able to buy a car, about mortgages to buy a home. Give them examples, tell them which mistakes you made. Let them know how you managed. You can even decide that your child can borrow money from you. With a younger child you can, for example, agree that they will not get pocket money for a certain number of weeks. With a teenager, you can agree on a pay off schedule and include a low-interest fee, so they understand what borrowing money and budgeting entails, and what the consequences are of their decision to buy something they cannot (yet) afford. It is a way to raise financial awareness in a safe environment.

Last but not least, keep educating yourself! Find out how you can manage your finances and prepare for your family’s future. You could start by signing up for BFE’s newsletter!